Picking the right commercial solar financing option is an important first step in getting a system installed at your business.

Whether you want to lease or own your business’ solar solution, energy companies like Sunnova offer a variety of flexible, affordable plans allowing you to choose one that makes the most financial sense.

If you’re not yet sure what the best commercial solar financing option is for your organization, this breakdown — each starting with a high-level overview and then digging into the benefits of Sunnova’s plan — is designed to point you in the right direction.

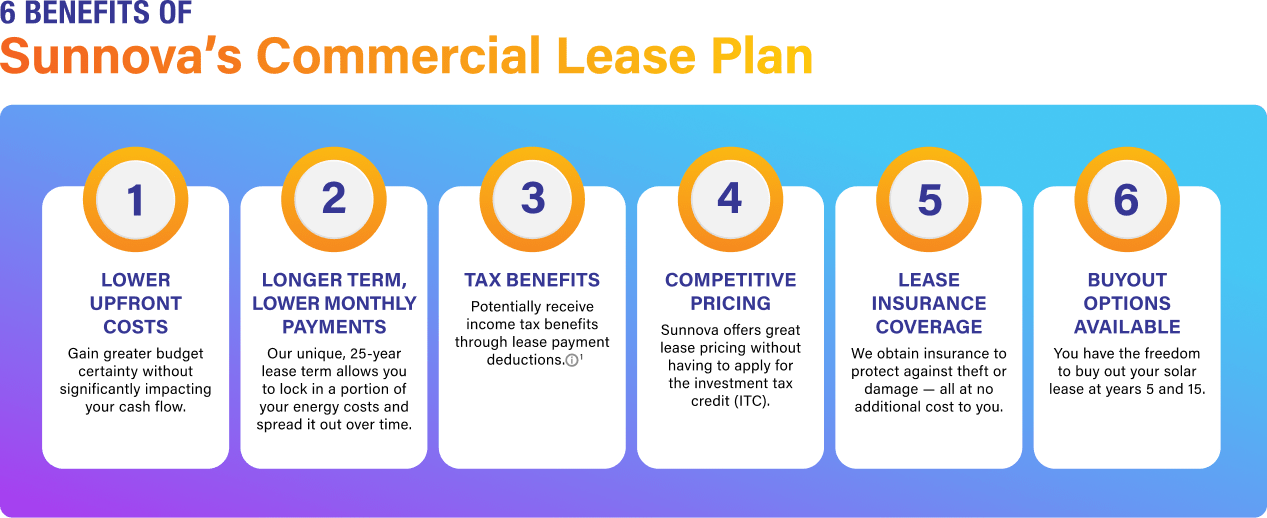

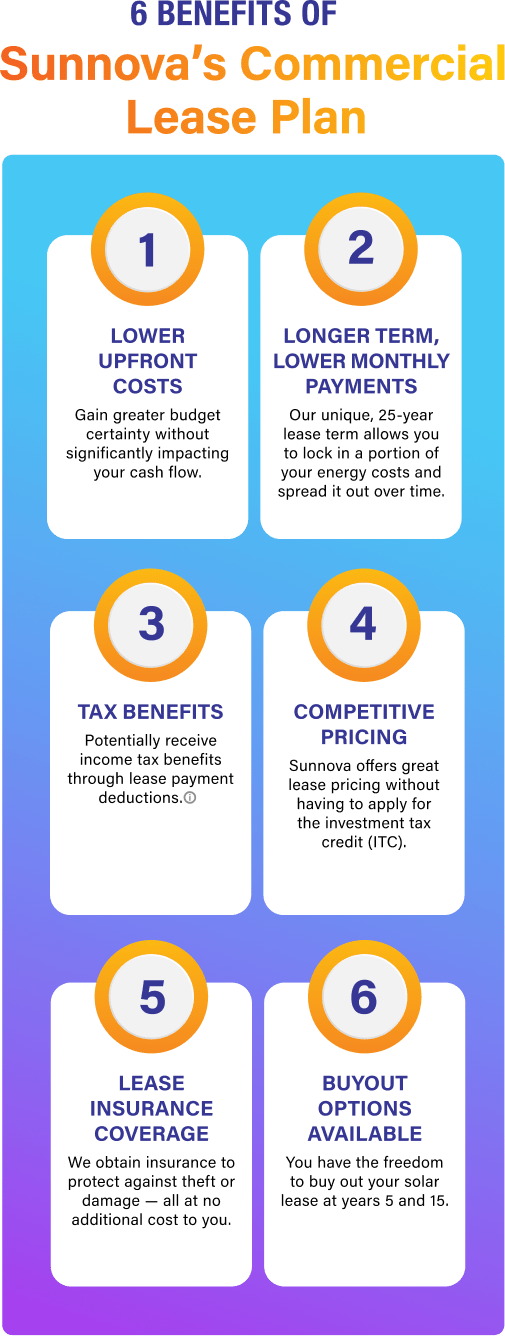

Commercial Solar Lease

With a commercial solar lease, you’d pay a predictable monthly fee to use the equipment offered by your solar provider. It’s a popular choice for businesses that want to invest in solar without breaking the bank.

A lease might be right for your organization if:

- You want to go solar without significantly impacting your cash flow.

- You don’t have the tax liability to take advantage of the federal tax incentive.

- You don’t want to increase your expenses by adding the system to your insurance.

- You can’t take on any more debt in order to keep a certain debt-to-income (DTI) ratio.

Sunnova makes no guarantees regarding eligibility of any of the system’s costs for tax benefits. Sunnova does not provide tax advice. Contact your tax advisor for eligibility requirements.

Want to lease a commercial solar system?

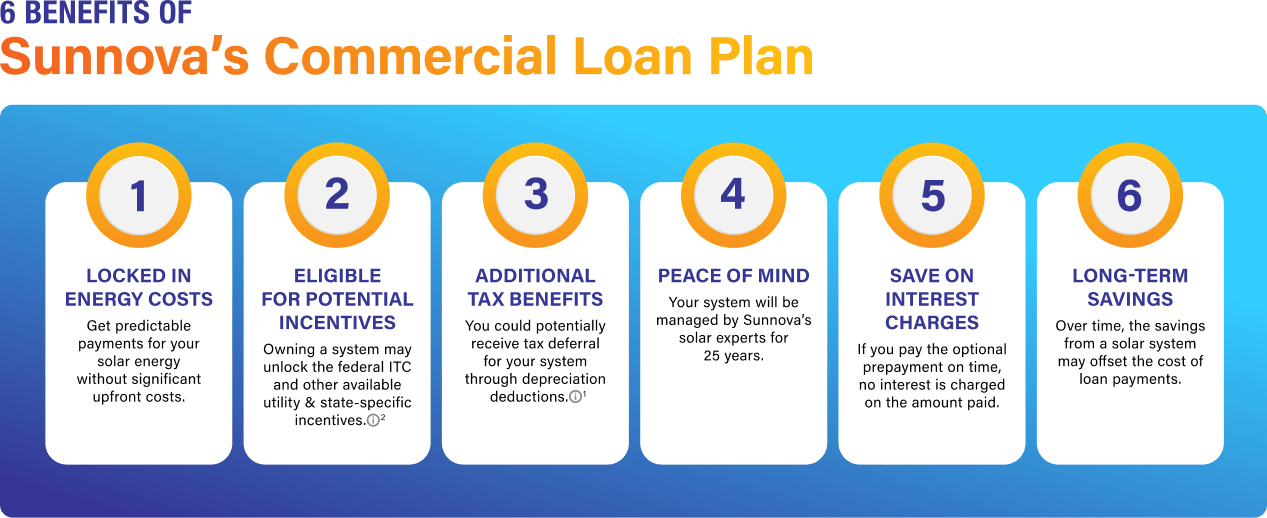

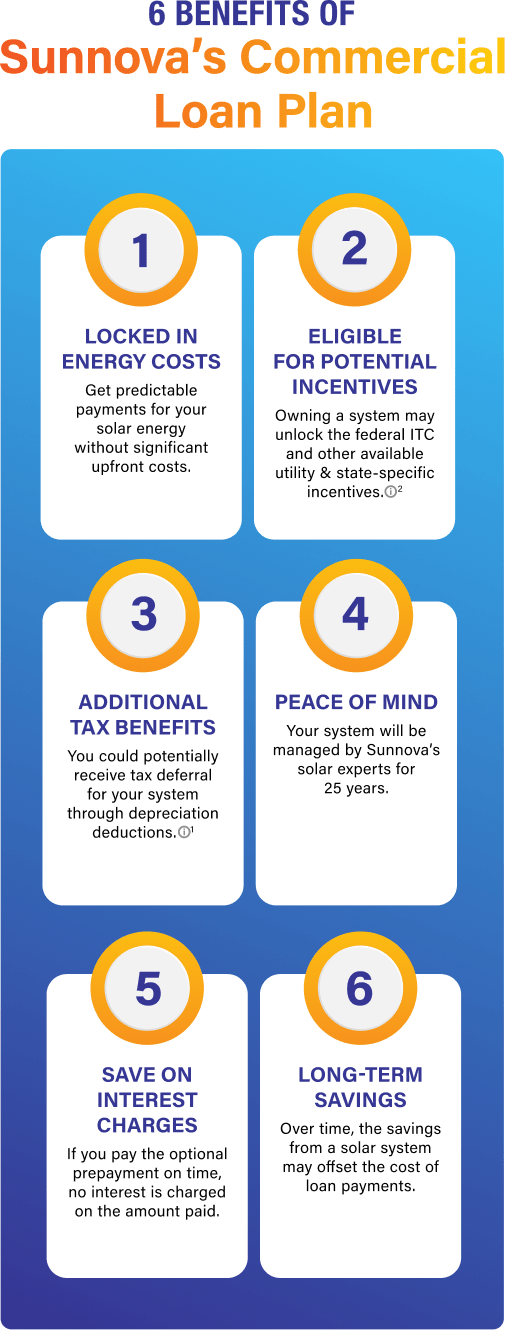

Commercial Solar Loan

If you’re looking for a more direct investment in your solar power, then a solar loan is the financing option for you. Just as you would with any other capital investment, your business would take out a loan to purchase and install your commercial solar panels.

A loan might be right for your organization if:

- You want to go solar without significant upfront costs.

- You can take on more debt and not have any DTI concerns.

- You have the tax liability to take advantage of federal tax incentives.

Sunnova makes no guarantees regarding eligibility of any of the system’s costs for tax benefits. Sunnova does not provide tax advice. Contact your tax advisor for eligibility requirements.

1. Sunnova makes no guarantees regarding eligibility of any of the system’s costs for tax benefits. Sunnova does not provide tax advice. Contact your tax advisor for eligibility requirements.

2. You may be eligible for a federal tax credit with the purchase of a solar system. To qualify for the tax credit, you must have federal income tax liability at least equal to the value of the tax credit. Tax incentives are subject to change or termination by executive, legislative or regulatory action. Sunnova makes no guarantees regarding eligibility of any of the system’s costs for tax benefits. Sunnova does not provide tax advice. Contact your tax advisor for eligibility requirements.

Get your commercial solar loan now.

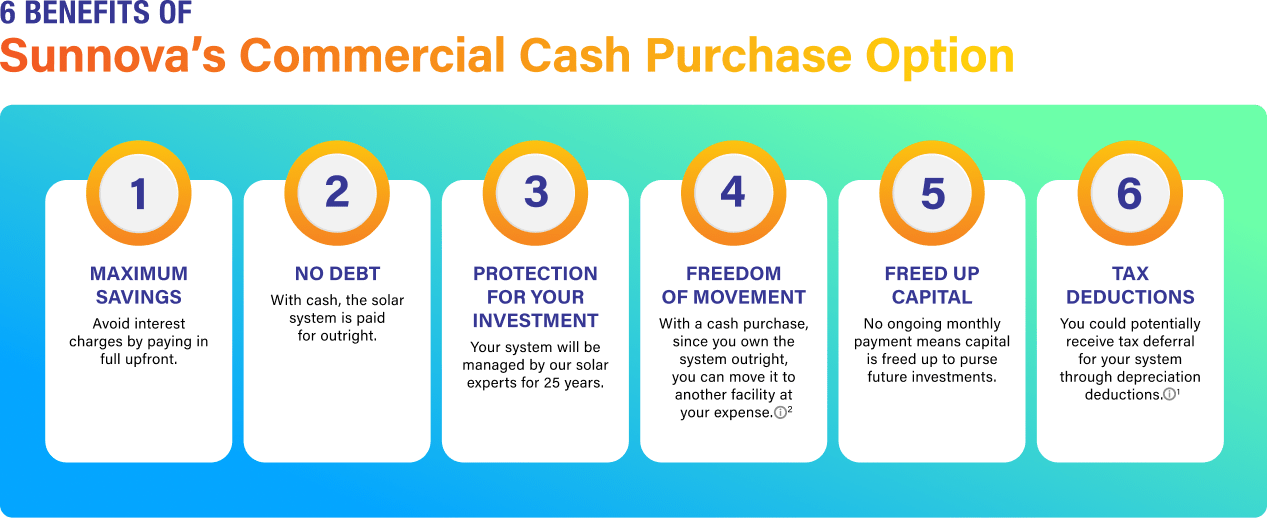

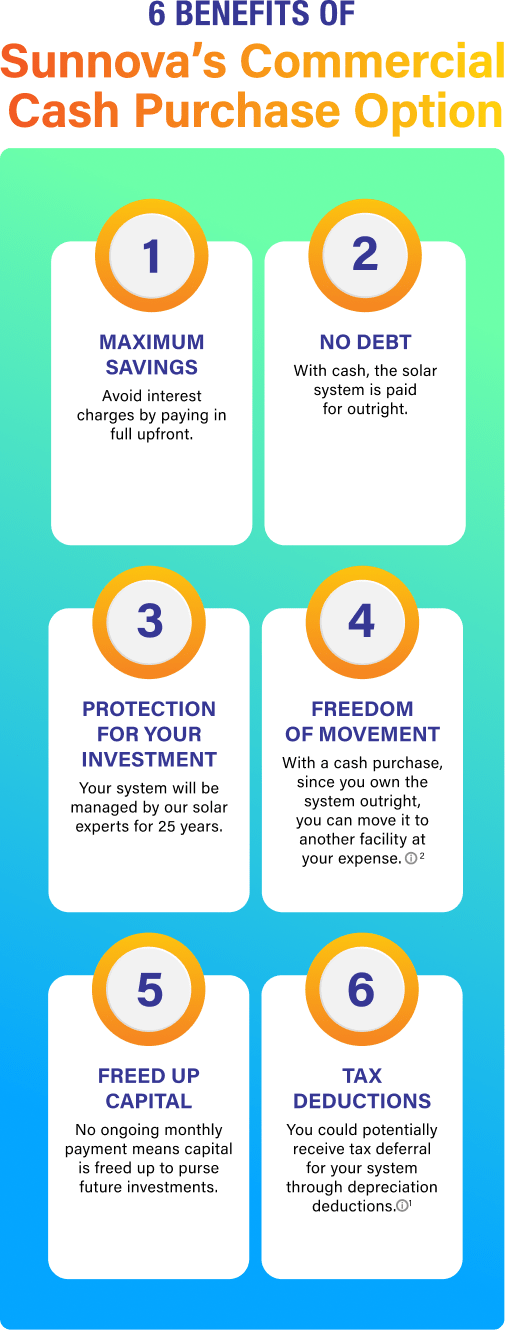

Commercial Solar Cash Purchase

If your business has the resources, paying cash upfront for your commercial solar system can be a smart, sensible investment.

A solar cash purchase might be right for your organization if:

- You don’t want to or can’t take on any more debt.

- You’re profitable and need to offset some of your federal taxes.

- You have cash on hand to pay upfront but want up to 25-year coverage.

Sunnova makes no guarantees regarding eligibility of any of the system’s costs for tax benefits. Sunnova does not provide tax advice. Contact your tax advisor for eligibility requirements.

1. Sunnova makes no guarantees regarding eligibility of any of the system’s costs for tax benefits. Sunnova does not provide tax advice. Contact your tax advisor for eligibility requirements.

2. Each energy plan is unique and, therefore, the way in which Sunnova handles relocation varies with each. With any plan, you must contact your dedicated Commercial Services Team to notify Sunnova who will provide a Sunnova-approved contractor for removal and reinstallations. To maintain your Sunnova Protect® Business coverage, you must use the Sunnova-approved contractor to disassemble and reinstall your system and pay any service fees incurred by Sunnova to inspect and restart the system. Please note, when removing and reinstalling a system, we cannot guarantee future performance, utility connection, or additional utility charges at the new location.

Start Your Commercial Solar Journey Now

Solar lease, loan or cash — if you think one of these commercial financing options is right for you, get in touch with our expert team to kick off a solar journey that’s personalized for your business.