From rugged coastlines to enchanting redwoods, from picturesque vineyards to dramatic deserts — California has it all. Home to more than 39 million people, the Golden State is a melting pot of culture, opportunity and natural beauty. But as the amount of carbon dioxide in the air causes our temperatures to warm, California is experiencing strains to its water supply, increasing wildfires, sea-level rise and greater smog in urban areas.*

To slow some of these harmful effects, the state has enacted policies to reduce the amount of carbon dioxide emissions in the air. Billions of dollars are being invested to mitigate changes to help our climate, from rebates on electric vehicles (EVs) and charging stations to solar mandates and tax incentives.

If you’re ready to save money on your utility bills, lower your dependence on gasoline, and reduce your carbon impact, then California solar incentives, battery rebates and EV charger credits can help you make those lifestyle changes sooner.

In This Article

1. California Solar Tax Credits

Federal Level: ITC for Home Solar

2. California Battery Storage Incentives

Federal Level: ITC for Solar Storage

Self-Generation Incentive Program (SGIP)

3. California EV Charger Rebates

Local Level: EV Charging Incentives

Lower Your Cost of Solar, Storage and EV Charging in California

1. California Solar Tax Credits

With its abundant sunshine and high cost of electricity, California is the nation’s top market for rooftop solar energy. In August of 2018, California enacted SB 100, which set the target of achieving 100% carbon-free electricity by the year 2045 and a move to 60% renewable energy by 2030.*

Because of that bill, the California Energy Commissions began requiring that all new single-family homes and multi-family dwellings up to three stories high, built in 2020 onward, to have solar panels installed (although there are some exemptions).*

While the cost of solar in the Golden State has fallen 47% over the past decade,*it’s still a significant investment. Homeowners who commit to solar energy may be able to take advantage of several California solar incentives and reduce the cost of clean energy adoption.

Federal Level: ITC for Home Solar

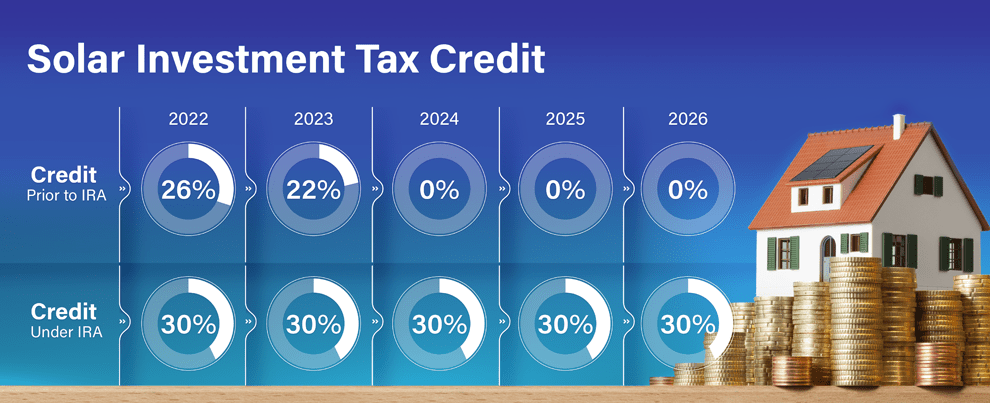

The solar investment tax credit (ITC) is one of the most important policies to support the widespread adoption of solar power in the United States. Since it was enacted in 2006, the ITC has been extended several times, helping the industry grow an average of 52% each year.* With the passing of the Inflation Reduction Act in August of 2022, the ITC has been extended through 2032. After that, the tax credit will decrease to 26% in 2033 and drop to 22% in 2034 before expiring the following year.

The federal tax credit helps solar customers who have purchased a residential solar electric system (via cash or loan) to deduct 30% of your total solar installation costs. It’s not a tax deduction, but rather, it reduces what you owe on your taxes. The ITC can be rolled over for up to five years as long as the taxes you owe are less than the credit you earn.*

If you’re considering going solar with a loan and you pay federal taxes, the ITC may enable you to get dollar-for-dollar reduction off the sticker price and can help you pay your system off sooner.

At Sunnova, we don’t give tax advice. Please consult your tax advisor to determine the incentives that you may qualify for.

State Level: Net Metering

California’s net metering program requires investor-owned utilities to credit solar customers for any excess power their panels produce and feed back to the power grid. The credits appear on homeowners’ utility bills and reduce the total amount they owe for any electricity supplied from the grid.

While net metering credits in California have been historically attractive, a new version of net metering — NEM 3.0 — went into effect in April of 2023. The new solar billing policy significantly reduces the value of solar-only systems and thereby encourages energy storage.

NEM 3.0 implemented a handful of changes (read about them in detail here), but the most impactful was reducing the value of solar exported to the grid by more than 75%. However, even with this decline, the cost of California’s electricity still makes going solar more financially appealing than in most other states.

Learn how you can maximize your savings under NEM 3.0

Installing solar panels in California may help you reduce your carbon footprint and reduce your electricity bills, but your solar power won’t stay on if the grid goes down unless you have a way to store it. In places like California that are prone to fires, public safety power shutoffs (PSPS), flooding and other severe weather events, solar battery backup is becoming more common — and rightfully so. Adding a battery to your solar system allows you to save the clean energy your panels produce and use that power at night, on rainy days when production is limited, or during a power outage.

As battery technology improves, solar storage is slowly coming down in price. Still, it’s a considerable upfront investment. Fortunately, there are battery storage incentives that you may qualify for.

Federal Level: ITC for Solar Storage

The same ITC that reduces your cost of installing solar by 30% may be available for a storage system you purchase. Before the IRA’s passing, your battery had to be 100% powered by on-site renewable energy, such as a solar array or wind turbine. Now, that’s no longer the case.

The 30% ITC now applies to batteries charged by solar, as well as standalone batteries that you plug into the grid. The only caveat now is that your home storage device needs to have a capacity of 3 kilowatt-hours (kWh) or more.

You may still be able to claim this tax credit if you add a battery to an existing residential solar system at a later date. Be sure to discuss your tax credit eligibility with a licensed tax expert.

California’s Self-Generation Incentive Program (SGIP) offers a rebate for qualifying homeowners who install energy storage technology, such as a solar battery, that can operate when the grid goes down.

As of 2024, there are three categories of SGIP rebates that a residential customer may fall into:*

- Equity rebates cover around 85% of the cost of a storage system ($850/kilowatt-hour) and are available for those who meet low-income guidelines or live in California Indian Country.

- Equity resiliency rebates cover nearly 100% of an average storage system ($1,000/kilowatt-hour) and are offered to those who live in a high fire threat area or have had at least two PSPS events and meet another qualification tied to income, medical needs or rely on an electric well pump for water.

- General market rebates cover about 15-25% of an average storage system ($150-$200/kilowatt hour), available to electric and/or gas customers in PG&E, SoCalGas, SCE and SDG&E service territories who don’t meet the requirements for equity or equity resiliency.

As a California homeowner, you can combine the SGIP rebate and the federal ITC to maximize your refund and reduce the amount of tax you owe.

One thing to keep in mind: if you install a project with storage, the SGIP rebate will apply first, and then the federal ITC will apply to your remaining project cost. So, if your gross project cost is $20,000 and your SGIP rebate is worth $3,000, then the 30% ITC will apply to your remaining $17,000. This order ensures that you don’t receive a tax credit for battery storage that you didn’t actually pay for.

Keep in mind that Sunnova doesn’t give tax advice and cannot advise you on the availability of any particular incentive. For the SGIP in particular, availability and the amount of the incentive is subject to continuous change. Be sure to consult your tax advisor to determine what rebates and incentives you may qualify for.

3. California EV Charger Rebates

Not only are today’s electric vehicles silent and sustainable, they’re also sleek and sophisticated. Models have evolved from pricey first-generation EVs to relatively affordable all-electric SUVs. The advances in technology combined with more options made consumer interest higher than ever. They’re getting farther ranges on a single charge and are being assembled with advanced connectivity features.

In a pledge to reduce greenhouse gases and address our current climate crisis, California has set the goal of selling 5 million EVs by 2030 and phasing out the sale of traditional vehicles entirely by 2035. Helping move toward carbon neutrality will help the Golden State reduce the impact of severe fires, extreme weather and rising sea levels. While there are different incentives you can explore for purchasing an actual EV, we’re going to focus on EV charging incentives in California.

About EV Charging

Interested in home EV charging? Sunnova offers Level 2 EV chargers that can give you more miles, faster.

While the national EV charger tax credit ran out several years ago, some utilities and municipalities have introduced their own rebates and incentives. These local incentives change often, as they tend to receive and run out of funding quickly.

Here are few examples of California EV charger rebates as of spring 2024:

Make sure to check with your local utility and see what EV charging incentives you may qualify for.

Lower Your Cost of Solar, Storage and EV Charging in California

If you’re ready to reduce your carbon impact and reduce your cost of solar in California, state incentives and the federal tax credit can help. Local rebates and incentive programs can also make energy storage and EV charging more appealing and accessible.

But solar credits and utility incentives won’t last forever. If you been considering solar plus storage and/or buying an electric vehicle to help lock in your energy costs — the time to act is now.

At Sunnova, we are energy service experts, not tax experts. Consult your tax advisor to determine the incentives for which you may qualify. Sunnova makes no guarantees regarding eligibility for tax benefits. Sunnova is not responsible for or liable for any errors or omissions in regard to your personal tax and finance situation or obligations. The information in this article does not, and is not intended to, constitute legal or tax advice.